Why Should You Borrow a Loan Online

Posted: 23-03-2023

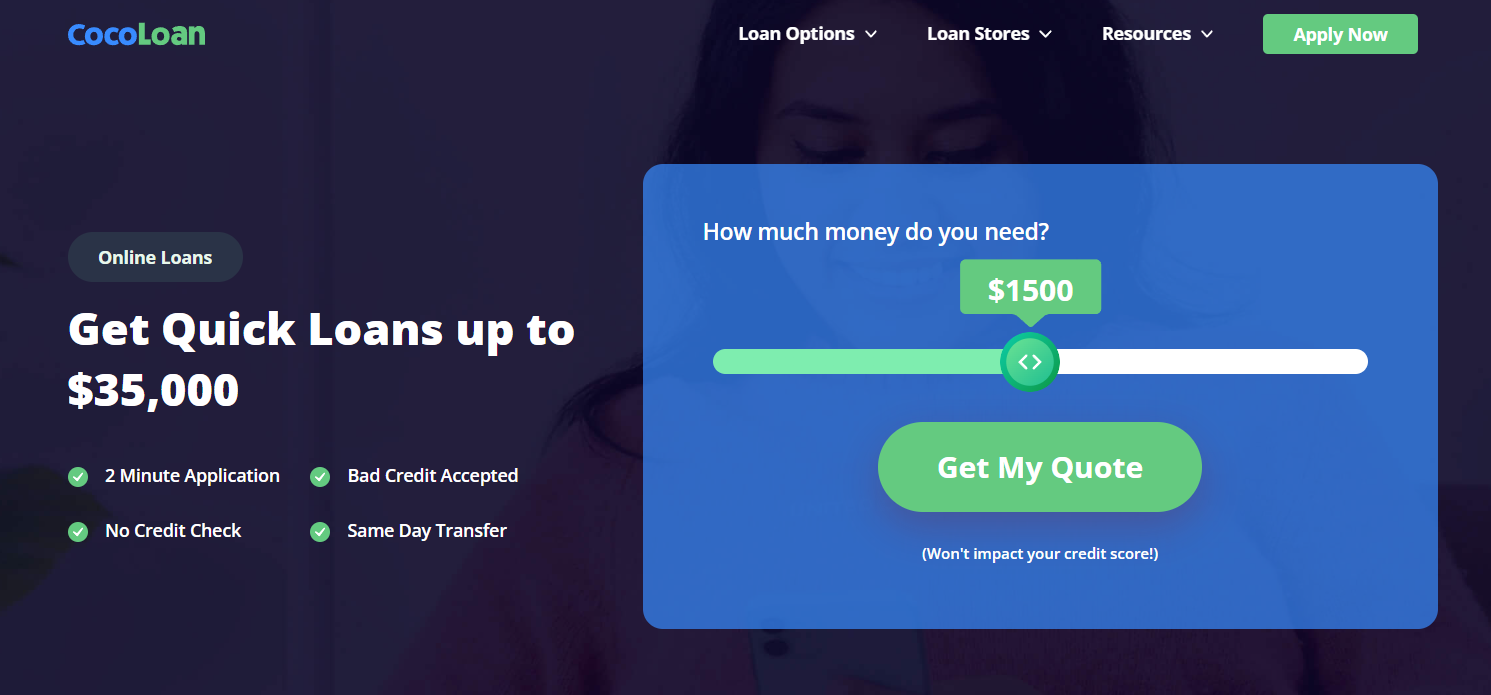

The newest generation of loan providers is more invested in making sure that the borrowing process is as simple and straightforward as possible. For instance, you can get all types of online loans via CocoLoan, with their partner lenders able to tell you almost instantly if you have been approved for funding or not.

This is in comparison to traditional lenders that often take days, if not weeks, to process an application because someone needs to review it. In this respect, we decided to break down all the main reasons why you should consider borrowing a loan online instead of heading to a traditional lending institution like a bank or credit union.

Benefits of borrowing loans online

Fast loan approval: As mentioned before, online lenders are able to tell you pretty much instantly if you have been approved or not. And this is primarily because most online lenders use automated systems to review loan applications, which means that you can often get a decision within minutes of submitting your loan request.

Competitive rates and flexible terms: Most online lenders do not have the same overhead costs that traditional lenders with physical branches typically have to pay. As a result, they are usually able to offer more competitive loan rates and flexible repayment terms, compared to most banks and credit unions, especially if you have a good credit score.

Easy loan approval: Most banks and credit unions are hesitant to provide borrowers with funding unless they have good credit scores. This is a problem because it essentially leaves out a significant portion of the borrowing market in the cold.

However, almost anyone can get an installment loan from this site, even if they happen to have a bad credit score because most online lenders look at other factors like income level and debt-to-income ratio when assessing loan applications.

Unsecured loans: Most loans that you will apply for online are typically unsecured, so even if you don’t have anything of value to put as collateral, there is still a chance for you to secure approval. However, do keep in mind that failing to repay an unsecured loan will often result in serious damage to your credit score and being charged high late payment fees.

Best Way To Secure A Loan Online Today

There are numerous online lenders out there that can provide you with the funding you need, even if you have a bad credit score. However, the problem with the online lending market is that it is heavily saturated and as such, it can often be difficult to identify which lenders can be trusted and which ones should be avoided.

It is for this reason that it is often a good idea to use a credit broker like CocoLoan, as they only ever partner with licensed and legitimate loan providers. And the best part is that applying for a loan using such a service is usually fairly simple and simple.

Step 1: Submit Your Loan Request

The first thing that you need to do is to fill out the online pre-approval form with your personal and financial details, eg. name, address, social security number, credit score, bank account details, etc. This process should only take you a few minutes to complete, at which point, you can submit the form and wait for your loan application to be reviewed.

Step 2: Compare Loan Offers

Once your form is submitted, you will be instantly matched with lenders within their network that are willing to approve your loan request. Each lender will make you an offer that has its own rates and terms to consider, so you will have numerous options to choose from. You can take your time to compare each loan offer until you find the one that best suits your budget and requirements.

Step 3: Accept The Offer

Once you pinpoint the right loan offer, you only need to e-sign the agreement, at which point the lender will start to process your funds. In most cases, you can expect to receive your funds as soon as the next business day.

How To Improve Your Chances of Securing An Online Loan?

The good news about securing an online loan is that it is often easier than applying to a traditional lender like a bank or credit union. However, there are a few things that you can do to improve your chances of getting the funds that you need.

#1. Avoid asking for too much money

It is important that you avoid requesting more money than you can comfortably afford to repay each month. Besides the fact that it can make it difficult for you to meet your monthly repayments on time, most lenders will usually look at your income level to gauge what you can actually afford to borrow.

In other words, the more squeezed your monthly budget looks, the less likely you are to secure approval. In this respect, you should always review your monthly earnings to estimate the exact amount that you can comfortably afford to repay before applying for a loan.

#2. Get a co-signer

If your credit score happens to be below average, then adding a co-signer that happens to have a better credit rating can often improve your chances of securing approval.

However, you need to have an honest conversation with them and get them to agree because it will mean that they will be equally responsible for repaying the loan if something bad affects your ability to repay it.

#3. Always pre-qualify to find the right lender

One of the best ways to ensure that you secure loan approval is by pre-qualifying in advance. This means reviewing the loan rates and terms available to you, as well as the lender’s minimum credit score requirements, before submitting your loan application.

You can often use credit services like CocoLoan, as they make it easy to instantly compare loan offers until you find the lender that is most willing to provide you with competitive loan rates and terms.

Alternatives Options To Borrow Money

#1. 0% APR credit card

A 0% APR credit card can be a great way to borrow money without having to worry about paying any high-interest rates, as long as you pay back the balance within the introductory period.

This can usually last between 12 months and 21 months, during which time zero interest will be charged on any purchases or payments that you make. In this respect, it is an option that is only suited to borrowers that

#2. Borrow from family or friends

If you know someone in your life, like a family member or friend, who can lend you the money you need, you can always consider asking them for a loan.

This will enable you to avoid high-interest rates, especially if you have a bad credit score. On top of that, you can agree to a repayment plan that is flexible and suits your current financial situation best.

However, it is vital that you approach such loans with caution, as failure to make your repayments can seriously damage your relationship with them. This is why it is often a good idea to put any agreed-upon terms and conditions on paper and then have them signed to avoid any potential conflict.

Bottom Line

As we’ve shown above, there are numerous benefits to taking out online loans rather than always relying on a bank or credit union for your financing needs. However, keep in mind that to secure yourself a competitive online loan, it is important that you take the time to shop around.

A good rule of thumb is to make use of an online credit broker like CocoLoan to compare multiple lenders, which will ensure that you are not only partnering with a reliable and trustworthy loan provider but are also securing the best deal possible.